Jenny from the Block (chain)

Jenny from the Block (chain)

I recently started working on some Hyperledger stuff, which from what I can tell at this early stage, is an opensource blockchain technology of sorts. Which got me to thinking; can I explain blockchain to my parents?

Have you heard about Blockchains?

The answer was a resounding No.

What about BitCoin?

The answer was ‘yes’ but with caveats. It seems that my aging parent folk have associated this particular crypto-currency with scams and the dark web.

Okay, we have a starting place, how do I rescue this?

I mean, what can I say, they are technically correct though somewhat narrow in vision. Let’s start from the basics.

2008 - a reason for Crypto Currency

As a reminder, 2008 saw the world come to the brink of a complete economic meltdown. We saw a number of Western banks go under, some of which were very large historic institutions. We eventually saw governments and central banks across the globe step in to save other banks from going under. The idea was that if confidence and stability could be returned to the financial world, the rest of society could come back from the edge of this global meltdown.

In fact, what we ended up creating was a new monster that relies on an endless influx of capital from the central banks, either in the form of Quantative Easing or incredibly low interest rates.

Time for a change…

Now you have to remember that we were living in the midst of one of the worst financial meltdowns in modern history caused entirely by the greedy bankers packaging up fake debt ridden products and selling them to one-another. What the world needed was a more transparent way of managing finances, something that couldn’t be controlled by a few greedy bankers using opaque practices to confuse pretty much everyone that wasn’t a greedy banker.

The blockchain concept in general as well as digital currencies are older than 2008, but 2008 give purpose to one or many clever people operating under the pseudo-name of Satoshi Nakamoto. Nakamoto took earlier work and improved on the ideas. I think the most important of which was the ideas around decentralisation and not requireing new blocks to be signed by a trusted central power. The idea being to avoid a single ‘powerful entity’ that might be corrupted and manipulate the system for their own gain.

Building blocks

It’s interesting that for the first 8-10 years of the blockchains life (as we know it today) the word was in fact two words (block chain) but at some point, it became popularised as a single word. Indeed you have a block, that represents transactions and a chain which shows how one block links to another, two words described the technology perfectly in my opinion.

The Transactions

Transactions can, in theory, be anything, great examples would be things like supply chain management, where transactions can help build a history for what item from what supplier ended up in a finished product. The most famous blockchain is probably the bitcoin blockchain which records how bitcoins are created and used and by who (who is used for simplification at this point).

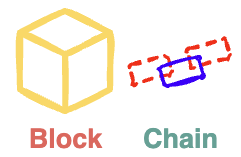

A block is a collections of these transactions along with a little cryptography.

The Cryptography (perhaps not for the parent folk)

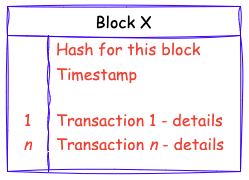

Each block includes cryptographic hashes, these are used to validate the transactions and to link a new block with the one that came before it.

We have a hash for the current block and a hash for the block before it. The hash is a mathematical function that can take input of different sizes and produce an output of a designated size. That’s to say that whist we can not predict what data will go into the hash, we can predict what the output hash size will be. This is important because if all the hashes are the same size, it is essentially impossible to predict what data went into the creation of the hash (impossible to reverse engineer the hash to get the original data).

Each new block needs to meet what is known as the target hash, this is a moving scale, as the amount of computing power increases, the target hash decreases which in turn makes it harder to find the target hash. Should the total computing power available to the network decrease, the target hash increases which makes it easier for the network to find the magic number.

To add to the difficulty, there is a nonce (number used only once). Therefore a new block contains a block header, a hash of the previous block, all of the transaction data recorded in this block, a time stamp and a nonce which is all hashed up together to create a hash for the current block.

Okay, so this is probably something I’ll gloss over when talking to the parent folk, it’s so easy to get lost in this bit.

The blockchain

The blockchain is a mostly public ledger of transactions (though private blockchains are plentiful as well), linked together by a chain of hashes.

Because the blocks are linked together, it is virtually impossible to go back and retrospectively change a transaction record. The term we use for this is Immutable that is to say, it cannot be changed.

The Who

Not the band… I said earlier that the blockchain records who did what, when and how much it cost (for example). Actually it’s a little more complicated than that. What we can see are the wallet addresses of the transactions. If we know which person in the real world owns that wallet, then we know what transactions they’ve been involved in.

However, good wallet practice suggests that for the purposes of anonymity we should use different wallets for different types of transactions making it much harder for the outside world to know who is party to a particular trade.

This of course brings us back to the parent folks opinion that bitcoins are used for scams and by bad actors. Indeed there has been a rise in ransomware attacks where the victim can un-encrypt their files if they deposit fractions of bitcoin into a wallet address, this is done because it is harder to figure out who the real end-recipient of the ransom is.