Ethereum, the new money

Ethereum, the new money

I previously wrote about the blockchain as a kind of blockchain 101 post, but it was smashed in the comments. Not just because I skimmed over bits or oversimplified others, but because this blog used to be a WordPress site and every single bot in the WordPress community spammed me with crypto-scams, so I promptly de-listed the post, just to give my mailbox a rest.

This post is my 101 to Ethereum. Again, nothing heavy, the tech is amazing, but really the message needs to be aimed at people that don’t understand the tech if we ever want this to be a part of the new web.

More Scams?

Originally I’d asked the parent folk what they thought about the blockchain which provoked blank stares, it was only when I mentioned bitcoin that the lights switched on, but they associated it with scams and bad actors.

Ethereum doesn’t have the same reputation from what I can tell, my parent folk haven’t heard about it at all. There are pro’s and con’s to this.

Pro’s

Ethereum is not a tainted technology, convincing my parent folk to learn more about bitcoin is like asking them to learn more about some criminal underworld, they might show minor interest, but don’t want to find they’ve taken a wrong step somewhere and are suddenly on some ‘naughty list’.

Con’s

If the regular world doesn’t know much about Ethereum, how can it hope to replace existing financial instruments?

If Bitcoin is Digital Gold, Ethereum is digital coins and notes

Ethereum is so much more than bitcoin. Heck bitcoin is so much more than what bitcoin is still associated with to be fair.

Where bitcoin may be the new digital gold, as in a long term investment that is finite in quantity and should therefore only appreciate over the long term, Ethereum is the instrument that can replace fiat money and the institutions that control the flow of that fiat money.

What is fiat money?

Fiat money is the term used to collectively describe money that is not backed by a commodity like gold. In days gone by, all money was backed by a commodity, something along the lines of ‘the holder of this $100 bank note is entitled to $100 of gold’ or something like that.

The problem with commodity backed currencies was that it was difficult to create new money if it was limited by the amount of gold you had. So somewhere in the early 1970’s the US government (with other countries following) stopped backing the US Dollar with gold. By having the freedom to create new money without the constraints of gold in the federal reserve, the US government was able to lend more money, allowing businesses to invest and hire new staff (at the time the US had a relatively high unemployment rate).

This wasn’t all good, it briefly fixed the problem but led to a period of stagflation and indeed these measures were only meant to be temporary. The temporary part was soon dropped, the financial world got used to this free money and soon found ever more complex ways of spending it.

Digital Gold

So getting back to the new world technologies, it has been said that bitcoin is a digital gold.

It has this association because it is mined (like gold) and it is limited in quantity (like gold). Getting the gold out of the ground is getting harder, we’ve already extract all the known easy deposits, new gold is in harder and harsher places, requiring greater investment in order to access it.

Bitcoins are similar, the number of new bitcoins is designed to halve roughly every 4 years until we reach 21,000,000 which will be around the year 2140.

Once all the bitcoins have been mined, any future rewards will be the bitcoin transaction fees only.

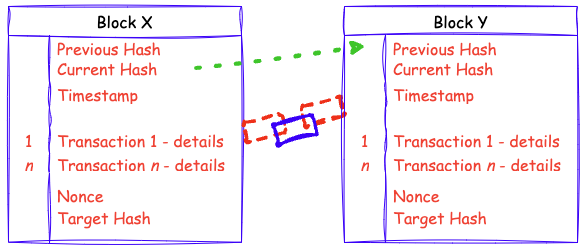

Okay, so if you’re not familiar with the bitcoin process, at a high level;

- All devices in the blockchain compete to find a target value known as a hash (how the target hash is reached is beyond scope)

- This is a computationally difficult process requiring investment in time and processing power (mining)

- Whoever finds the hash first is rewarded with a number of bitcoins

- As the amount of power in the network (the number of computers taking part) grows, the target hash decreases, making it harder to find the target hash

- Every 4 years, the reward for finding a new hash decreases until eventually there are no more bitcoins available

Whilst the target hash is beyond the scope of the blog post, understanding that transactions data is part of that hash is important. Transaction data will be things like ‘which wallet received the new bitcoins minted in last block’ and ‘who transferred bitcoins from X wallet to Y wallet’ for example.

The reason this is important is because a miner not only receives free bitcoins for successfully finding the target hash, they also receive a reward in the form of transaction fees, these fees are what participants in the network have paid to register their transaction. This is similar to using a credit card, you probably don’t pay a fee, but the retailer will pay a fee to allow you to pay with your credit card. Therefore the card company makes money in part by offering credit to the end customer and in part by making retailers pay for the ability to take card payments.

Bitcoin transactions follow a similar idea, we pay whoever finds the target hash a fee as a reward for the work they did in the network.

How is Ethereum different

Ethereum is more than just a currency, in fact, ethereum isn’t a currency at all. Ethereum is a blockchain that can be used to deploy permanent and immutable decentralised applications on to it.

There is a coin, known as Ether which is second only to bitcoin in terms of market capital.

The Ethereum blockchain is more like a financial institution, like a bank, it can be used for things like loans, but again, it’s more than a bank.

Let’s consider the NFT or non-fungible token. This is kind of like proof of ownership, again, something a financial institution of today may hold, like they may hold the title deed for your home (until you’ve paid off the mortgage) or perhaps you pay for a safety deposit box to keep your rare stamp collection in. An NFT is kind of like a record or proof of ownership.

NFTs

A couple of years back, the NFT popped up and it kind of became popular in a game called crypto kitties, at the moment it’s a bit of a strange thing, kind of off to the side of the blockchain world, but there are some exciting ideas for how this could be used in the future.

People trade digital pictures, but I question the value in this really, I mean, much like real-world art, something is only worth what someone else is willing to pay for it. However, the ability to replicate digital art seems too easy for the digital art to hold any real value, at least in my mind.

Where we go in the future could be more interesting, for example, perhaps your plane ticket is an NFT, it’s yours, it’s an immutable record of your trip to your dream holiday. Perhaps the Land Registry could use NFT’s as a way of transferring land ownership records or large scale events, like a music event or an F1 race, if tickets were minted as NFTs it would make it harder for ticket touts to buy up all the tickets and then sell them at a mark-up on reseller sites.

Ethereum is more than just a cryptocurrency

Okay I’ve made this a little bigger than I planned but what we’re seeing is that Ethereum is going to be more than bitcoin, it should really be worth more than bitcoin (in market capital) but it started later. What we can do with ethereum shows that the future of the physical world financial institution is coming to an end.

We should expect a lot of lobbying from those big old financial institutions, they represent the old money, they favour the ‘old boys club’, they use opaque practices to make the system seem overly complex. In short, it is not in their interest for some new tech to come along and replace them.